TikTok Shop Wins Over Consumers

Since its launch in September 2023, more than 11% of U.S. households have made purchases through TikTok Shop, according to data from a recent report from Earnest Analytics, which analyzed credit card transaction data to learn more about TikTok Shop users.

Consumers don't just use TikTok for social inspiration, they actually shop on the platform.

According to the report, TikTok Shop sales in February 2024 accounted for 68.1% of total social shopping merchandise transactions (GMV).

Whatnot, the live shopping app, accounted for 31% of GMV, while Instagram Checkout, Facebook Shop, and Flip app combined accounted for less than 1% of GMV.

This report excludes data from Facebook Marketplace, where many consumers search directly for used goods, giving it a strong lead over social buyers.

According to eMarketer projections, 64.6 million U.S. consumers will buy goods through Facebook this year, compared to 40.7 million on TikTok.

While TikTok Shop encourages users to shop directly on the platform, Facebook and Instagram are moving away from embedding checkout functionality on their platforms to using ads to direct users to other platforms to complete their purchases.

While TikTok did not win over the U.S. government, TikTok Shop won over consumers, attracting more repeat customers over time.

In February 2024, 81.3% of TikTok Shop sales came from existing customers, up from 64% in November 2023, according to Earnest Analytics.

Gen Z adults ages 18 to 24 are 3.2 times more likely to shop at TikTok Shop than the general adult population, according to the report. While not surprising, it validates the fact that brands need to be on TikTok to maximize their reach to Gen Z.

But that's not the only way to reach younger consumers.

According to eMarketer's Gen Z Path to Purchase report, Instagram, retailer websites and even brick-and-mortar stores all play an important role in how Gen Z shops, which means brands should have a presence on all fronts to ensure success.

Meanwhile, TikTok Shop users are just as price-sensitive as anyone else.

In the 12 months ending February 2024, TikTok Shoppers spent 26% of their apparel budgets at low-priced department stores and 11% on fast fashion, compared to 24% and 7%, respectively, for non-TikTok shoppers.

According to a survey conducted by Intelligence Node in partnership with Dynata last December, the main action digital shoppers in the U.S. are taking to combat the rising cost of shopping is to find discounts and coupons.

Brands can stand out on TikTok Shop by offering exclusive discounts, while also considering partnering with low-priced retailers like T.J. Maxx or Burlington to add a physical component to their strategy.

Another interesting finding is the high customer overlap between Shein, Temu and TikTok Shop.

About 28% of Shein customers engaged in shopping with TikTok Shop during its first few months online, which is one of the highest overlaps of any fast fashion or general apparel brand.

A quarter (25%) of Temu customers also shopped through TikTok Shop, as did 17% of Etsy, 14% of eBay and 12% of Amazon customers.

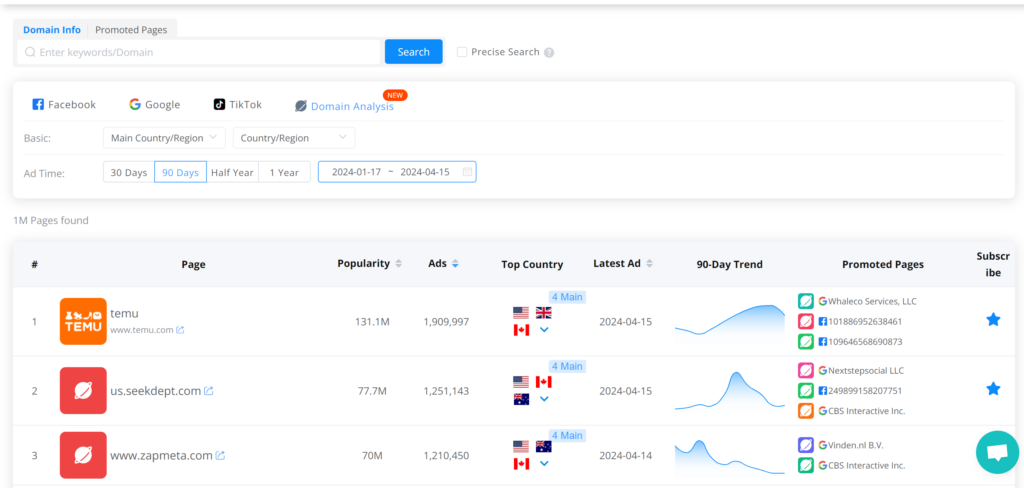

Competition between retail marketplaces is heating up.

From the launch of Temu in September 2022 to January 2024, Amazon lost 2.6 million daily active users, while Temu added 51.4 million in the same time frame, according to data reported by Forbes, as reported by the Wall Street Journal.

If TikTok is banned, it's one less marketplace in the race for consumer dollars. However, it also leaves merchants without an important marketplace to expand their reach among younger consumers.